The True Cost of Underinvestment: Opportunity Lost, Trillions Missed

Start investing where it matters. Support community funds, join a neighbourhood crowdfunding project, or mentor a founder from an underinvested community.

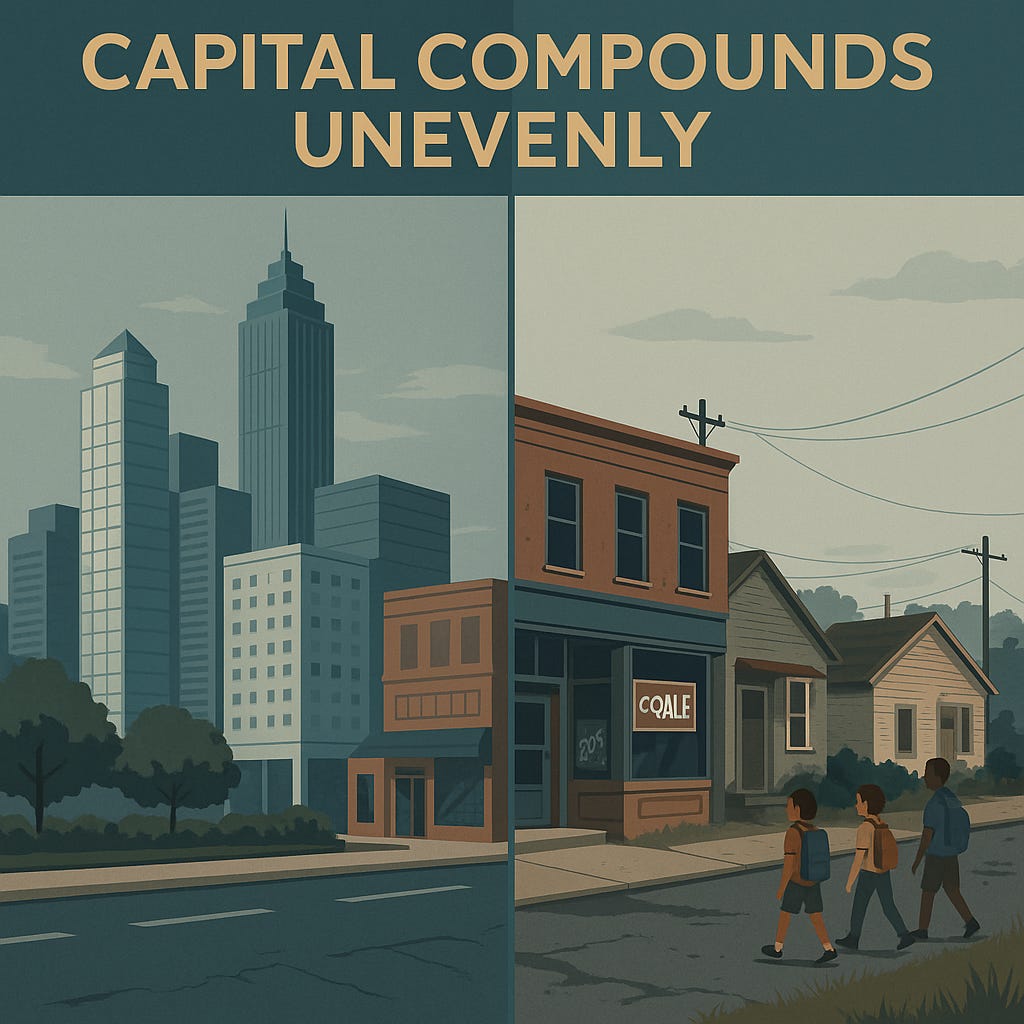

Underinvestment isn’t just a budget line — it’s a multigenerational tragedy. When capital avoids certain communities, it doesn’t sit idle; it compounds elsewhere. Those compounding returns build skyscrapers in one part of town while leaving others without a grocery store, broadband access, or basic infrastructure. The opportunity cost is staggering.

In the U.S., the top 10% of households hold roughly 74% of total wealth, while the bottom half holds just 2%. Nearly 40% of intergenerational transfers — inheritances and major gifts — go to the top decile. Trillions of dollars remain in the same hands, compounding year after year, while the communities that could most benefit from investment continue to see little to none.

The consequences are structural. Homeownership, long the cornerstone of middle-class wealth, remains out of reach for more than half of Black and Latinx families. Access to retirement plans and business ownership also lags significantly for communities of color. These disparities are more than inequitable — they represent massive lost economic output. If more families had access to home equity, retirement savings, and entrepreneurial capital, we would see measurable increases in consumer spending, small business expansion, and local tax revenue.

Fortunately, new models are emerging to bridge this gap. Community wealth-building initiatives — including neighborhood crowdfunding, occupant equity, and local institutional investment — are enabling residents to own stakes in income-producing real estate and local enterprises. Pooled investment vehicles are lowering barriers to entry for investors who’ve historically been locked out of traditional markets. These approaches demonstrate that investing in undercapitalized communities can yield meaningful social and financial returns, without waiting for policy to catch up.

The true cost of underinvestment isn’t just the money that never flowed — it’s the innovation that never emerged, the businesses that were never started, and the wealth that was never created. When we fail to invest in people and places, we forfeit trillions in potential GDP, tax revenue, and shared prosperity.

The Great 38™ is our invitation to do better.

Join the conversation. Share this post with someone who needs to hear it, and connect with The Wealth Salons to learn how you can help build wealth in The Great 38. Let’s co-create a future where every community has the tools to thrive.

Ready to build with us?

Whether you’re a founder, operator, or advisor—if you’re brilliant and ready to execute, we want to hear from you.

Stay Connected

Follow us for more insights, founder stories, and new opportunities:

🔗 LinkedIn | 𝕏 X | 📸 Instagram | 📬 Newsletter